The Power of Sitecore Personalization for Financial Services

How financial institutions are using Sitecore to deliver tailored, data-driven experiences across every touchpoint.

How financial institutions are using Sitecore to deliver tailored, data-driven experiences across every touchpoint.

Start typing to search...

The financial services industry is in the midst of a digital revolution. Competition is fierce, fintech disruptors are shaking things up, and customer expectations have never been higher. Today's consumers—especially younger, digitally savvy audiences—demand the same level of effortless, personalized experiences from their banks and investment firms as they get from retail and entertainment giants. But too many financial institutions still rely on outdated, one-size-fits-all service models, missing critical opportunities to build trust, deepen relationships, and drive growth.1

This is where Sitecore personalization comes in. With AI-driven insights, behavioral tracking, and real-time data, financial institutions can ditch the generic approach and actually meet customers where they are. Whether it's surfacing the right investment options at the right time or tailoring financial wellness tools to individual goals, personalization makes banking feel less like a transaction and more like a relationship. The result? Stronger customer loyalty, increased conversions, and a true competitive edge in a rapidly evolving market.

In this blog, we'll define real-world use cases of Sitecore personalization in financial services—how it works, why it matters, and the impact it can have on customer engagement and business success. If you're looking to enhance your digital experiences and keep pace with the evolving financial landscape, personalization is the key.

Delivering truly personalized financial experiences takes more than good intentions—it takes the right tools. Sitecore offers a powerful lineup of personalization technologies built to meet the needs of financial institutions at any stage of digital maturity. Depending on your tech stack and goals, here are a few ways you can bring personalization to life:

This blog will focus on Sitecore personalization use cases in the financial sector, but if you're curious about how these platforms stack up—we've put together a detailed comparison: Sitecore Personalization Deep Dive: XP vs XM Cloud vs Personalize.

Now, let's explore into how financial institutions can use personalization to create smarter, more intuitive customer experiences.

The financial services industry is navigating a transformative era, driven by changing customer expectations, rapid technological advancements, and intensified competition. Personalization has become a cornerstone for financial institutions seeking to meet these challenges head-on. According to Dynamic Yield, 86% of financial institutions prioritize personalization in their strategy, with 92% planning further investments in this area2.

Consumers now expect their banking, investing, and insurance experiences to be as smooth and intuitive as their favorite streaming or e-commerce platforms. Meanwhile, financial institutions must balance regulatory demands, cybersecurity risks, and emerging technologies—all while staying ahead of the competition. Let's break down seven key challenges shaping the future of financial services today.

Traditional financial institutions are under growing pressure as fintechs and tech giants like Apple and Google reshape the financial landscape with hyper-personalized, digital-first experiences3. Consumers have more options than ever—and they're choosing providers that offer instant approvals, no fees, and smart, AI-driven insights. To stay competitive, banks and credit unions must rethink how they engage users, leveraging personalized site experiences, guided selling, and dynamic content to deliver the relevance today's customers expect.

Today's customers don't just want personalized experiences—they expect them. Whether it's tailored financial advice, proactive loan recommendations, or AI-driven budgeting tools, financial institutions that fail to deliver relevant, hyper-personalized experiences risk losing customers to those that do1. The challenge? Legacy systems often stand in the way, making it difficult to leverage real-time data for meaningful personalization.

Financial institutions operate in one of the most highly regulated industries in the world, and compliance isn't getting any easier4. From data privacy laws like GDPR and CCPA to evolving banking regulations, financial services organizations must navigate an increasingly complex landscape. Failure to comply can lead to hefty fines, reputational damage, and loss of customer trust5. This means banks must invest in agile, AI-driven compliance solutions that help them adapt in real-time.

The rise of digital banking, mobile payments, and open banking APIs has introduced new cybersecurity risks. Financial institutions are prime targets for fraud, data breaches, and cyberattacks, with the cost of cybercrime in the banking sector projected to reach $10.5 trillion annually by 20256. To stay ahead, institutions must implement multi-layered security strategies—including AI-powered fraud detection, real-time monitoring, and customer authentication improvements.

Many financial institutions are still relying on decades-old infrastructure, making it difficult to implement modern digital solutions. Outdated core banking systems and siloed data make it nearly impossible to provide seamless omnichannel experiences. The financial institutions leading the charge are embracing cloud migration, API integrations, and AI-driven automation to enhance agility and improve service delivery7.

Chatbots, AI-driven investment advisors, and automated loan approvals are no longer futuristic concepts—they're the new standard. Financial institutions that successfully integrate AI into their customer experience strategies can significantly reduce operational costs, improve response times, and enhance customer engagement7. However, the challenge lies in balancing automation with human interaction—ensuring that AI enhances, rather than replaces, meaningful customer relationships.

Consumers no longer need to visit a bank to access financial products. With embedded finance, financial services are being integrated into everyday platforms—whether it's buying insurance through a ride-sharing app or securing a loan at checkout when making an online purchase. Open banking is also reshaping the industry, allowing third-party providers to access banking data (with customer consent) to create more competitive and innovative services8. This shift means financial institutions need to rethink their approach to partnerships, APIs, and digital ecosystems to stay relevant.

Customers expect banks and financial institutions to know what they need, when they need it, and to make it easy. With Sitecore, you can move beyond generic offers and surface smarter, more relevant experiences at every step. Here's a look at how financial institutions are using personalization to actually make an impact.

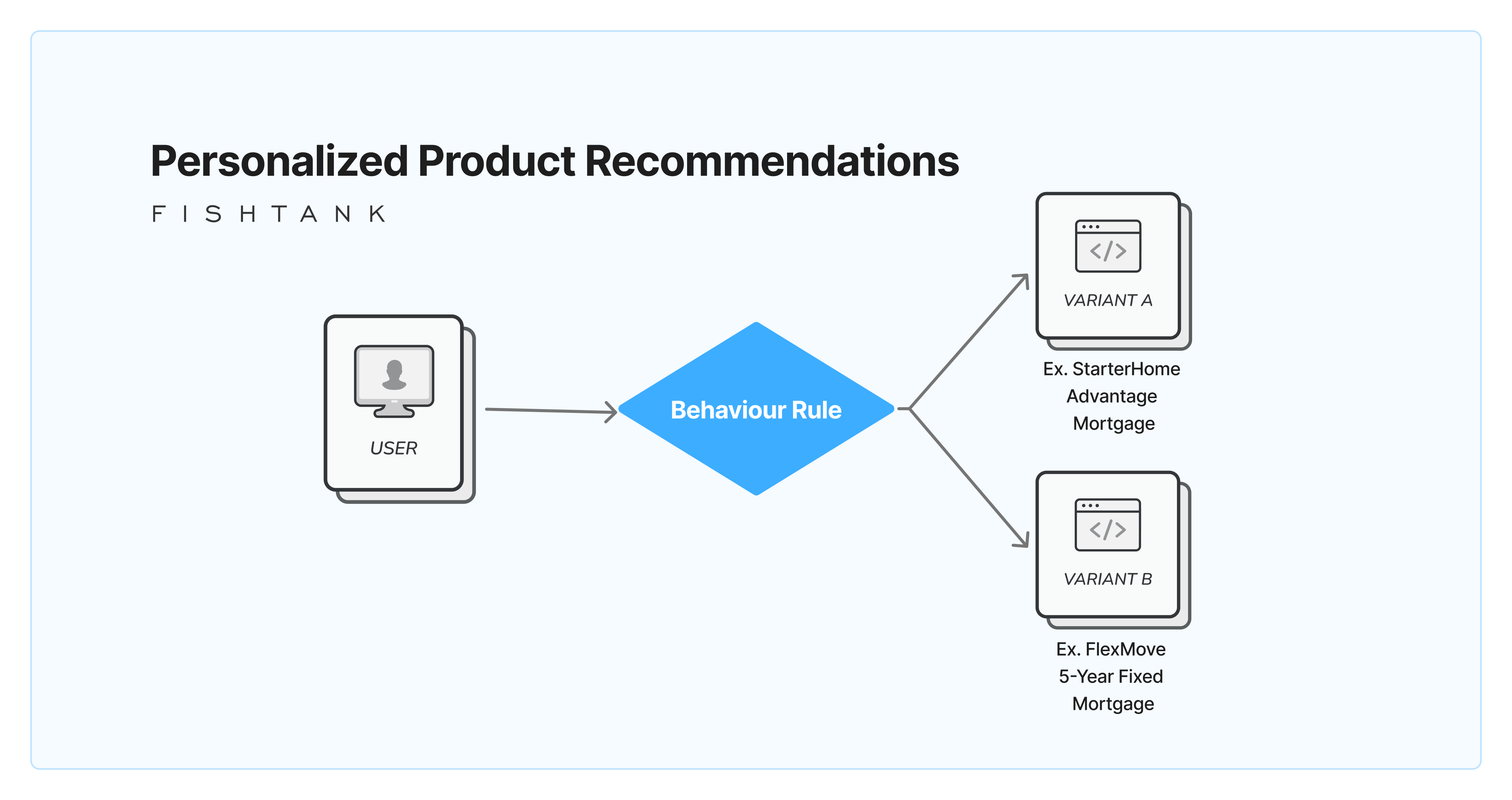

Customer Pain Point: Customers are often overwhelmed by too many product options—and underwhelmed by irrelevant suggestions. This leads to frustration and missed opportunities to connect them with products that actually meet their needs.

Personalization Approach: Deliver tailored product recommendations—like credit cards, savings accounts, or loans—based on real-time behavior, life stage, and financial profile.

How Sitecore Delivers It:

Expected Outcome:

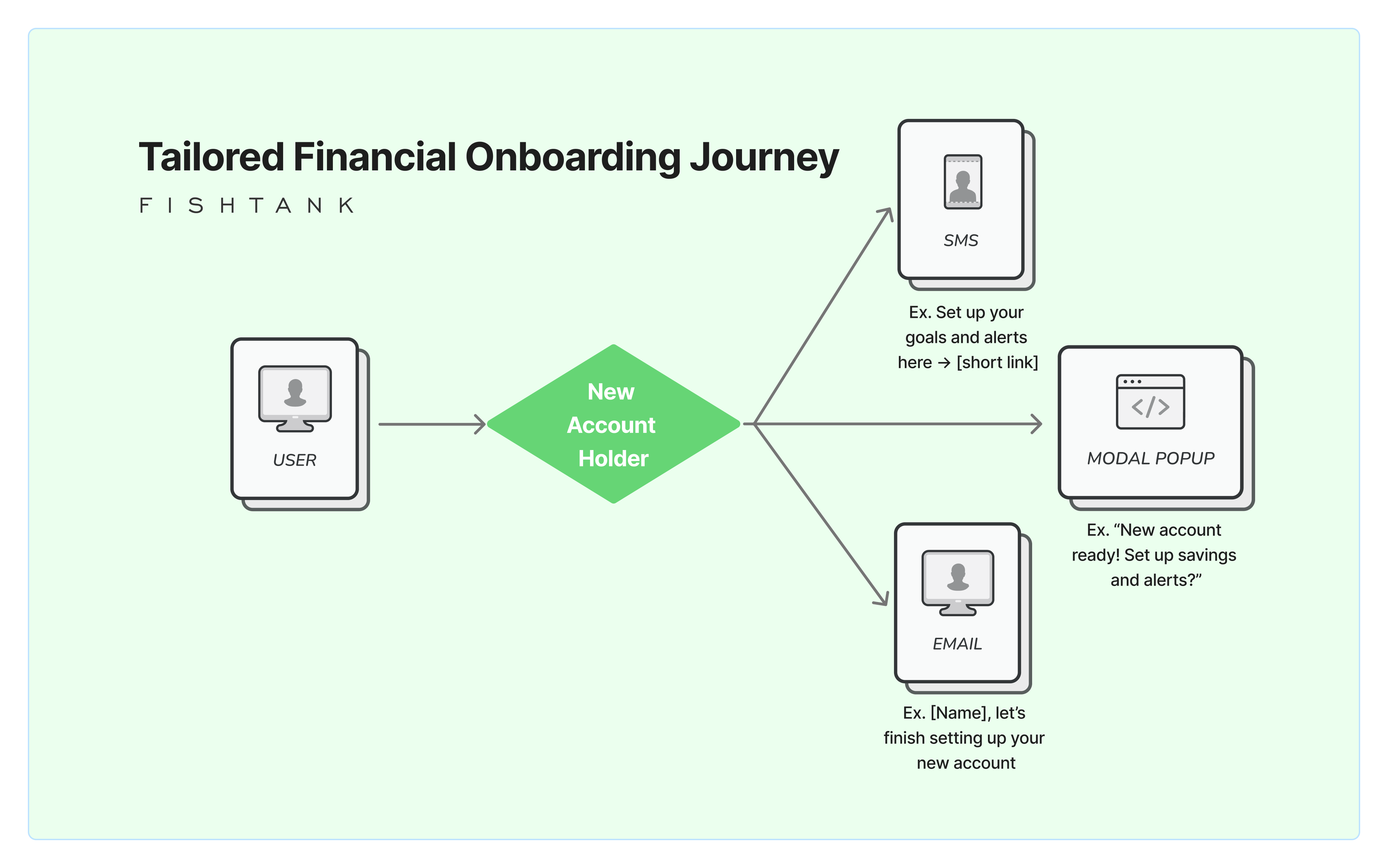

Customer Pain Point: New customers frequently drop off during onboarding when steps feel irrelevant, confusing, or too time-consuming.

Personalization Approach: Customize the onboarding process based on the customer's goals, chosen products, and channel of entry to reduce friction and increase completion.

How Sitecore Delivers It:

Expected Outcome:

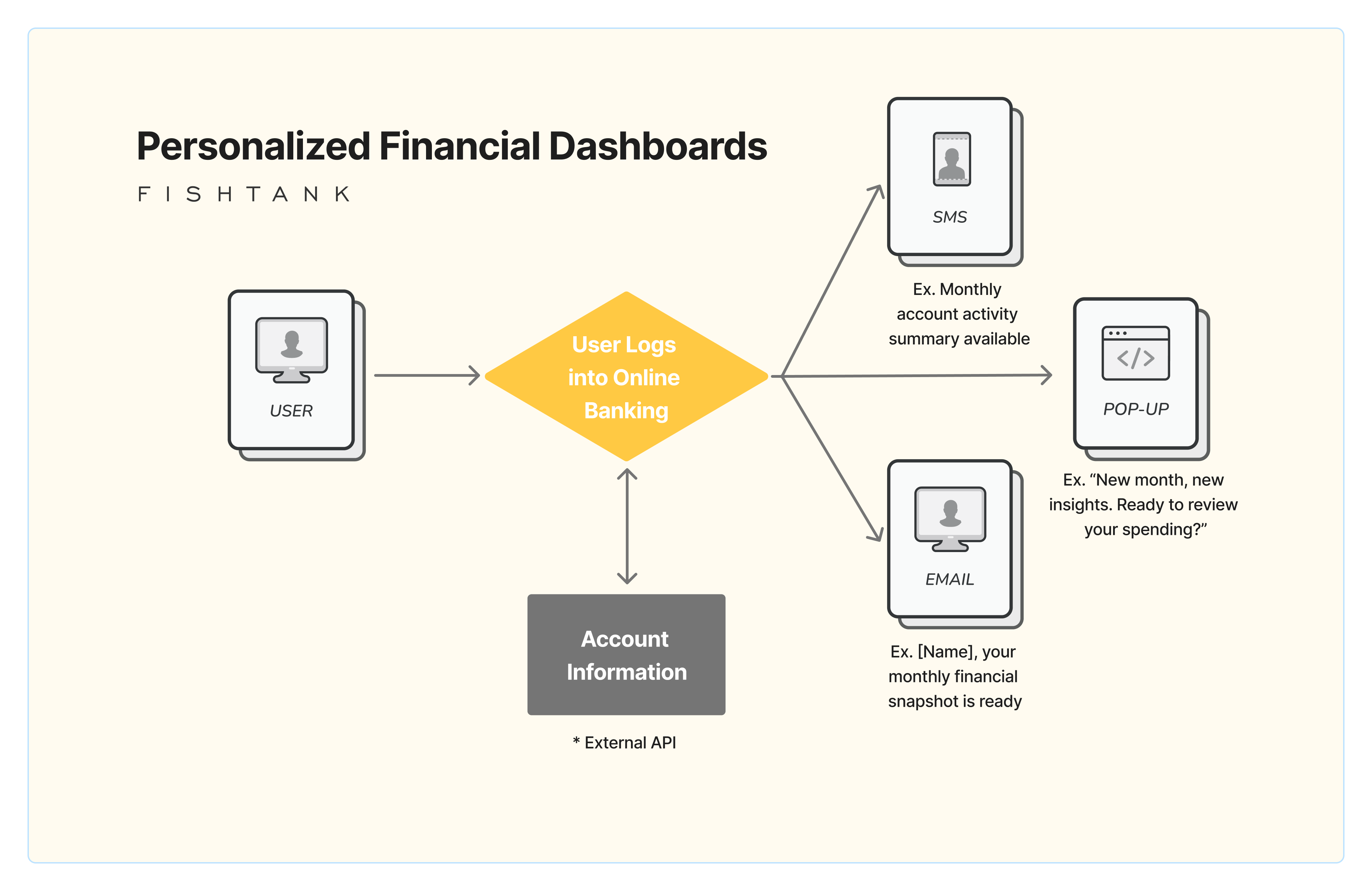

Customer Pain Point: Generic dashboards with basic balances and charts don't inspire customers to take control of their finances—or stay engaged.

Personalization Approach: Build dashboards that adjust to each user's goals, spending patterns, and financial behavior to offer tailored insights and next steps.

How Sitecore Delivers It:

Expected Outcome:

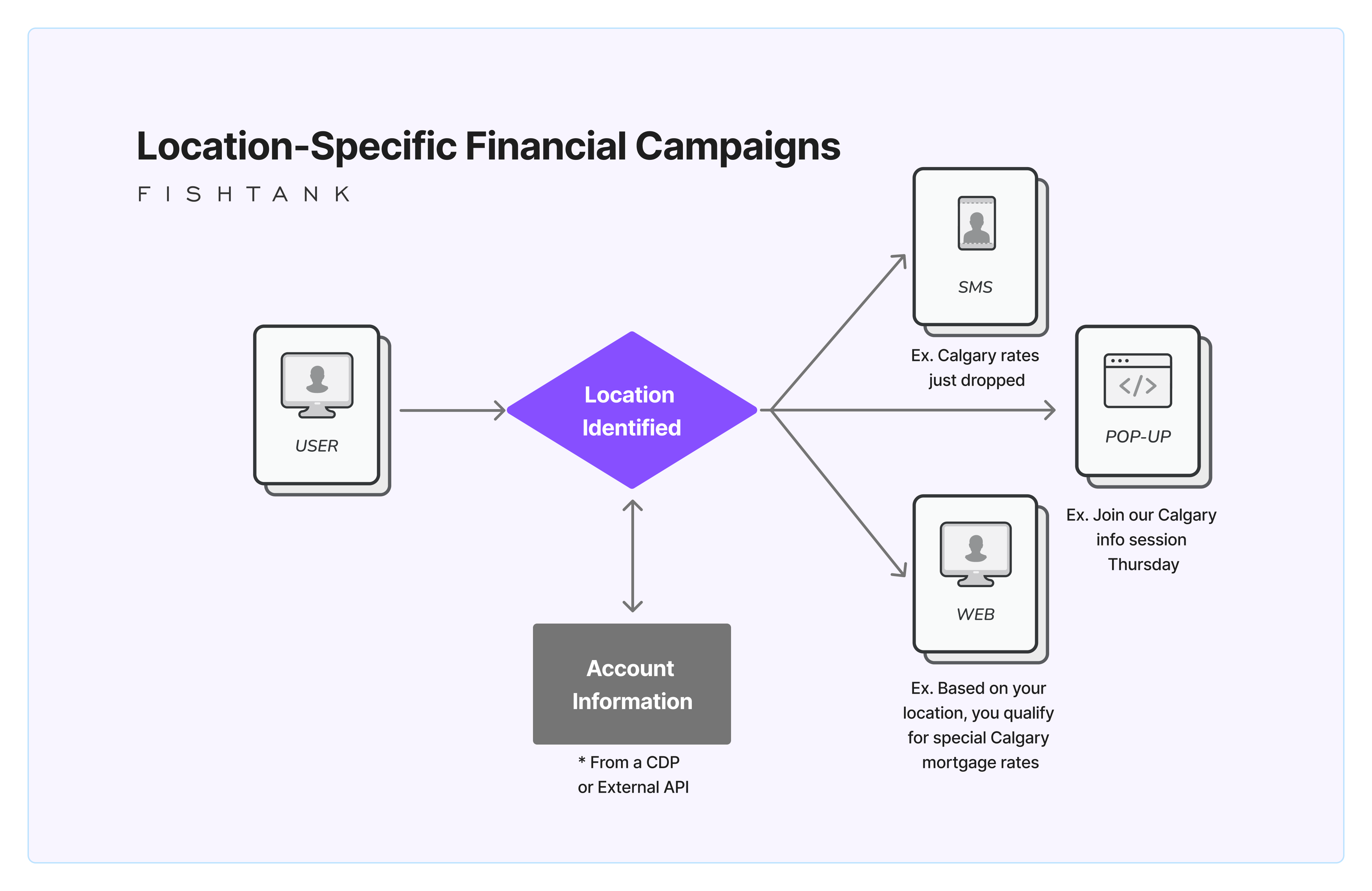

Customer Pain Point: National marketing campaigns often miss the mark locally, leading to poor engagement and a sense of disconnection from the institution.

Personalization Approach: Serve up geo-targeted offers, branch-specific messaging, and relevant events based on user location.

How Sitecore Delivers It:

Expected Outcome:

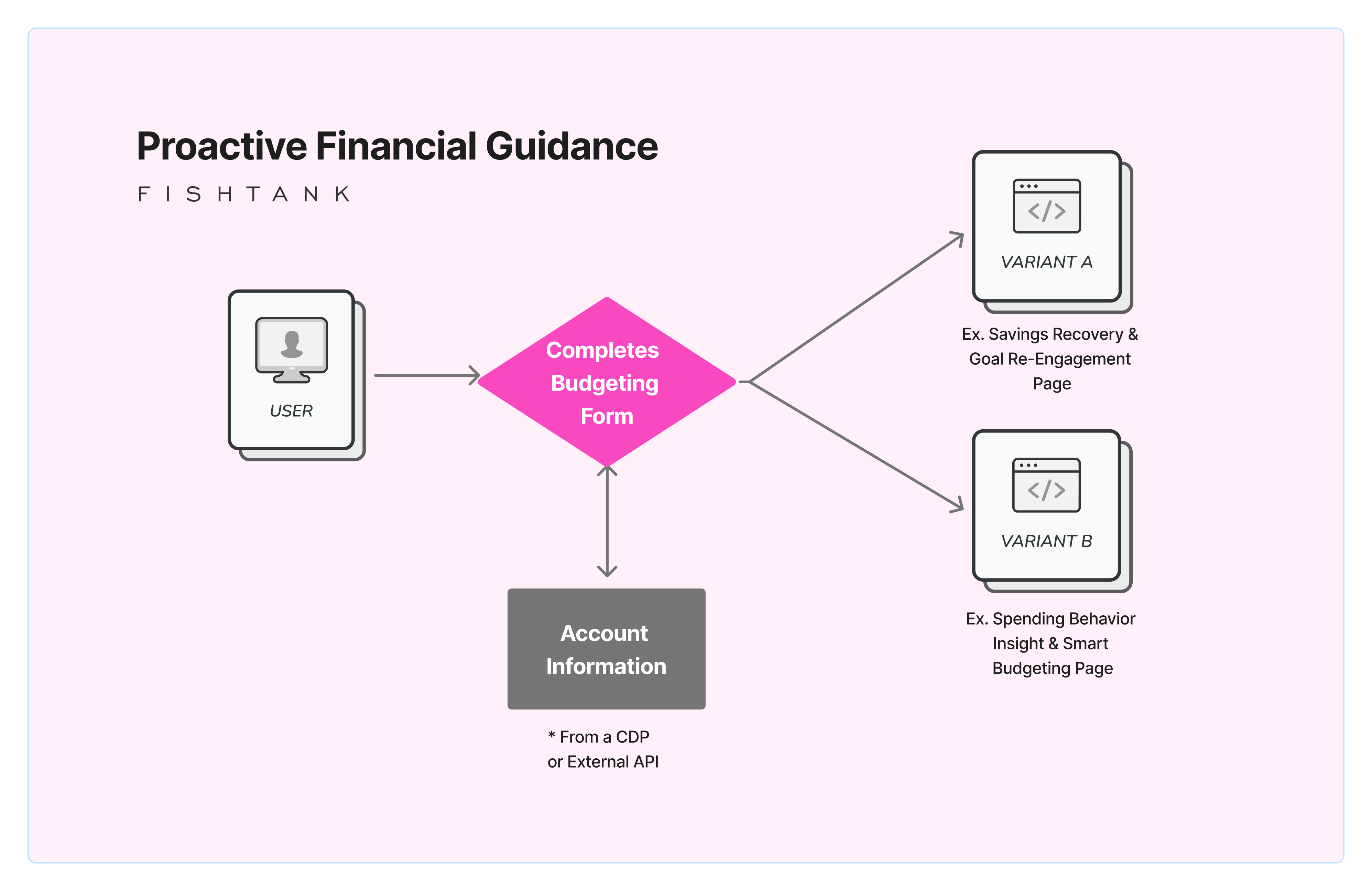

Customer Pain Point: Customers often don't know when to make changes—like paying off debt, increasing savings, or reviewing coverage—until it's too late.

Personalization Approach: Leverage rules-based personalization to offer recommendations based on financial behavior and milestones.

How Sitecore Delivers It:

Expected Outcome:

Personalization isn't just a digital perk—it's a strategic necessity for financial institutions looking to build lasting relationships, improve efficiency, and stay competitive. By delivering relevant, real-time experiences across every touchpoint, banks, credit unions, and wealth management firms can boost engagement, loyalty, and growth—while keeping operational costs in check. Here's how Sitecore personalization delivers real results in the financial sector:

Financial institutions that embrace Sitecore's personalization capabilities aren't just keeping pace—they're rewriting the rules of customer engagement. The future of finance isn't built on generic offers and mass email blasts. It's about delivering the right insight, at the right moment, through the right channel. Personalized, intuitive, and actually helpful. Sounds like the kind of experience your customers deserve, right? Of course.

If you've made it to the bottom of this blog—congrats. You're already ahead of the curve. At Fishtank, we help financial institutions bring Sitecore personalization strategies to life—building real solutions that drive loyalty, engagement, and growth.

Personalization isn't a luxury—it's the future of financial services. Ready to turn strategy into action? Let's talk.

Until then—happy personalizing.